- Код статьи

- S032150750010449-5-1

- DOI

- 10.31857/S032150750010449-5

- Тип публикации

- Статья

- Статус публикации

- Опубликовано

- Авторы

- Том/ Выпуск

- Том / Выпуск №8

- Страницы

- 36-43

- Аннотация

In this article the impact of foreign direct investment (FDI) on economic development of Ethiopia is studied. Starting from 2012 FDI inflow to Ethiopia, primarily from China, Saudi Arabia, Turkey, India, and European Union, is growing significantly.

The role of the Government in attracting FDI to the country is important. The Government continues to open Ethiopian economy to the foreign capital. In the article specific measures implemented by the Government, like generous investment incentives to FDI, infrastructure development and construction of industrial parks, are addressed. The analysis of the impact of FDI on economic development of Ethiopia in the article includes discussion of how FDI contributes to creation of new businesses, jobs, human capital enhancement, transfer of technologies, as well as export promotion. Sector analysis shows that FDI has an important impact on employment via job creation in launched greenfield projects and spillover effects in related value chain industries. New industries, like cut flowers industry, are created from the scratch.

Human capital enhancement goes through training of skilled workers and wider “learning-by-doing”. New forms of business training, for example, e-commerce training program are commenced. The analysis shows that in all of these directions the results are positive, though the efficiency of technology transfer is limited by the absorption capacities of the host country, and increased competition among exporting businesses may lead to crowding out of traditional domestic exporters. In general, the results show that FDI has a positive impact on Ethiopia’s economic development. The effect may be higher with the improvement of the business climate in the country.

- Ключевые слова

- Ethiopia, Foreign Direct Investment (FDI), economic development, unemployment, technology transfer, cut flower industry, export

- Дата публикации

- 08.09.2020

- Год выхода

- 2020

- Всего подписок

- 25

- Всего просмотров

- 8792

FDI INFLOWS TO ETHOPIA

In the last decade Ethiopian economy witnessed steady growth of foreign direct investment (FDI) inflows. FDI implies that the foreign investor manages and exerts a significant degree of influence and control over the enterprise resident in the other economy. To increase investment developing countries can draw on a range of external sources of finance, including FDI, portfolio investment, long-term and short-term loans (private and public), official development assistance, remittances and other official flows. FDI is the largest source of external finance for many developing economies, and the most resilient to economic and financial shocks. It makes up 39% of total incoming finance in developing economies as a group [1].

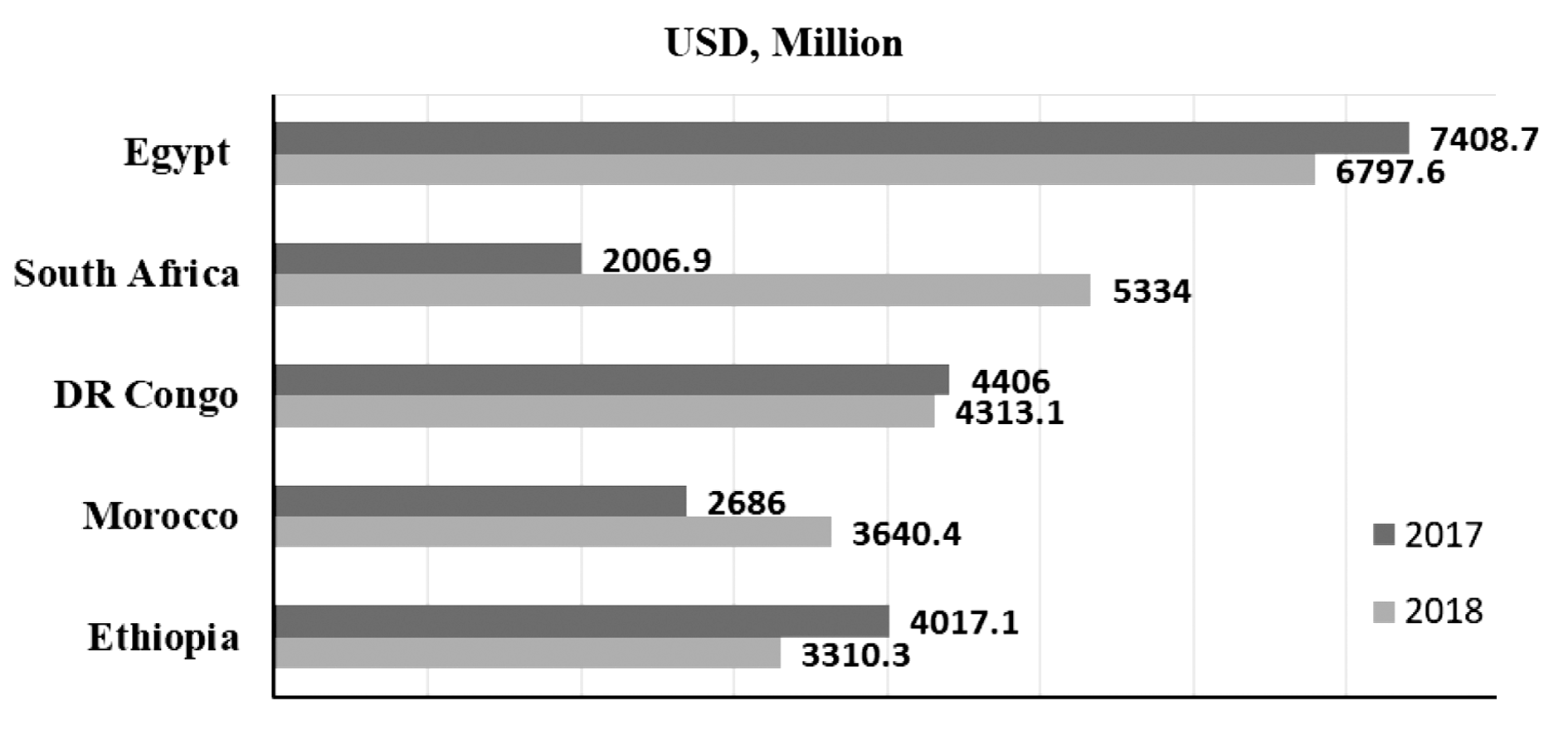

Ethiopia in 2018 was among the top 5 African countries, which attracted the bulk of FDI to their economies (see Figure 1).

Fig. 1. African FDI inflows: top 5 recipients ($ mln). Source: [2]

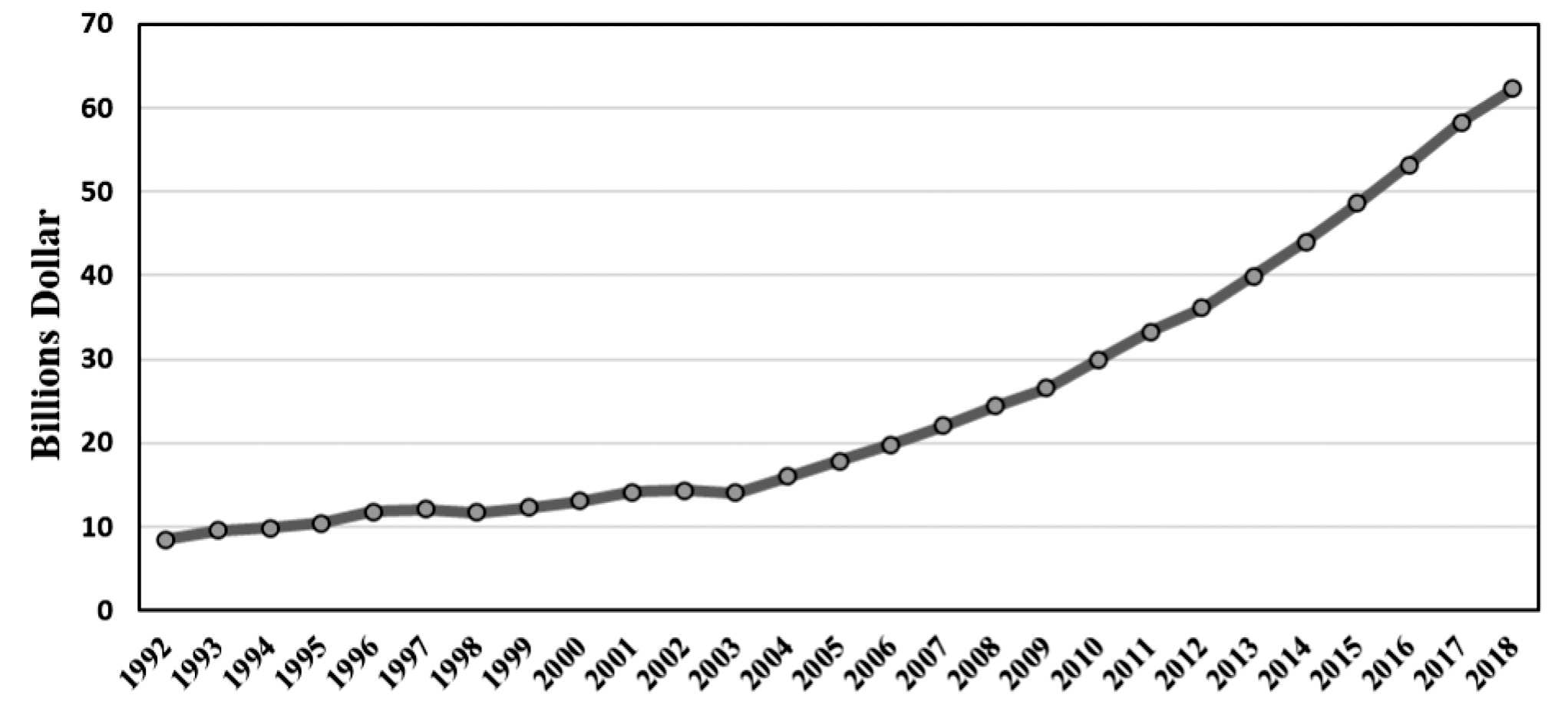

Fig. 2. GDP of Ethiopia, constant 2010 $, billion, 1992-2018. Source: [4].

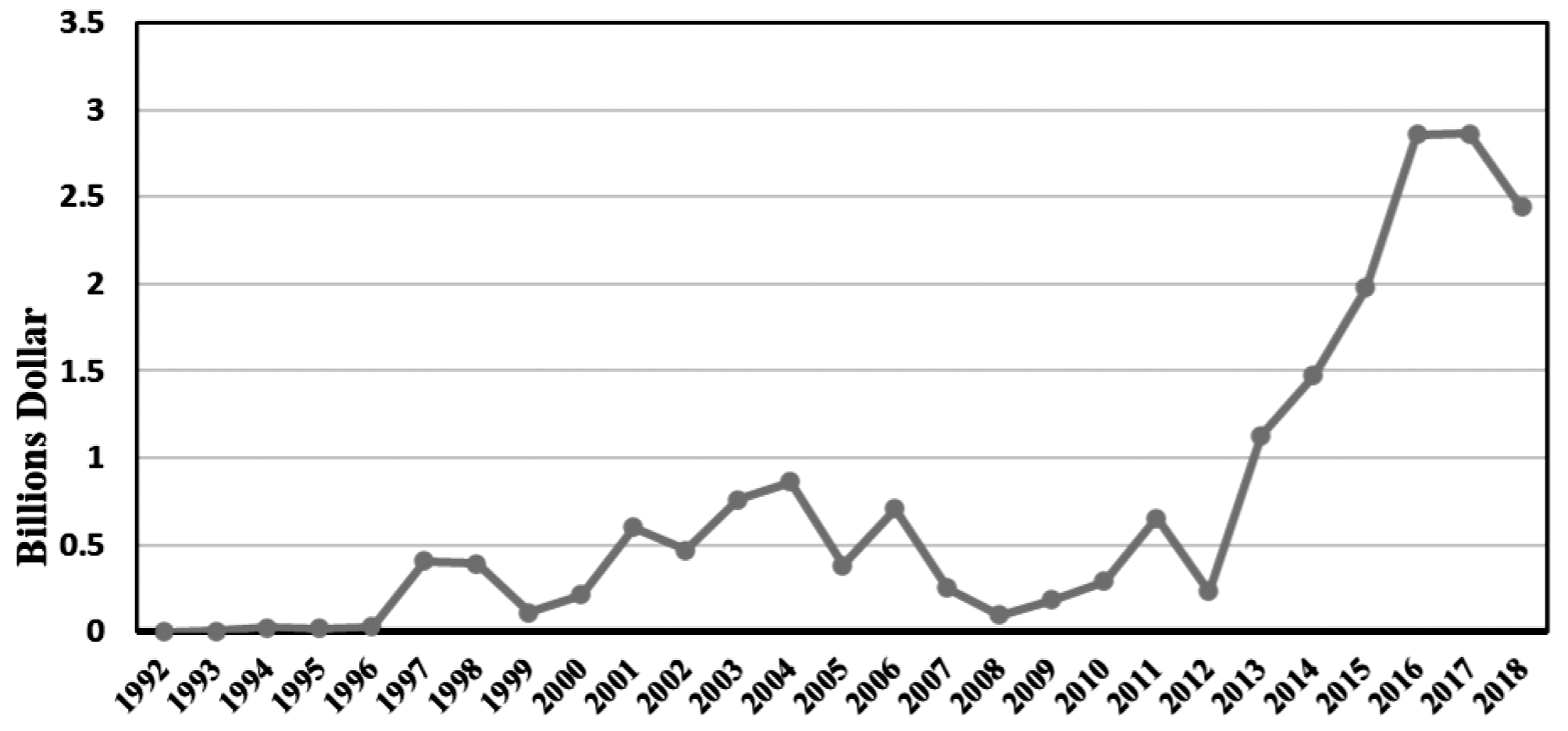

Fig. 3. FDI inflows to Ethiopia, constant 2010 $, billion, 1992-2018. Source: see Fig. 2.

Prime Minister of Ethiopia Abiy Ahmed, during his address at the 2018 World Economic Forum in Davos, Switzerland, promised to make Ethiopia one of the top investment destinations in the world in the coming few years by improving business climate of the country. As of now Ethiopia ranks 159 in World Bank’s Doing Business Index 2018 of 190 countries. To improve this, Prime Minister Abiy has set up a team that will be led by him that will address this issue. Mainly because of its generous investment incentives, the big market with over 100 mln people and its strategic location for other markets, many foreign investors are attracted to investing in Ethiopia [3].

FDI potentially can play an important role in enhancing the welfare of host country due to benefits related to development of industrial sector in the host country, modern technology transfer, new managerial and marketing techniques, development of skills of the local labor force, creation of job opportunities and improvement in the working condition of employees. The World Bank data shows that the inflow of FDI to Ethiopia is increasing from the period 1994 to recent, especially starting form 2012 [4].

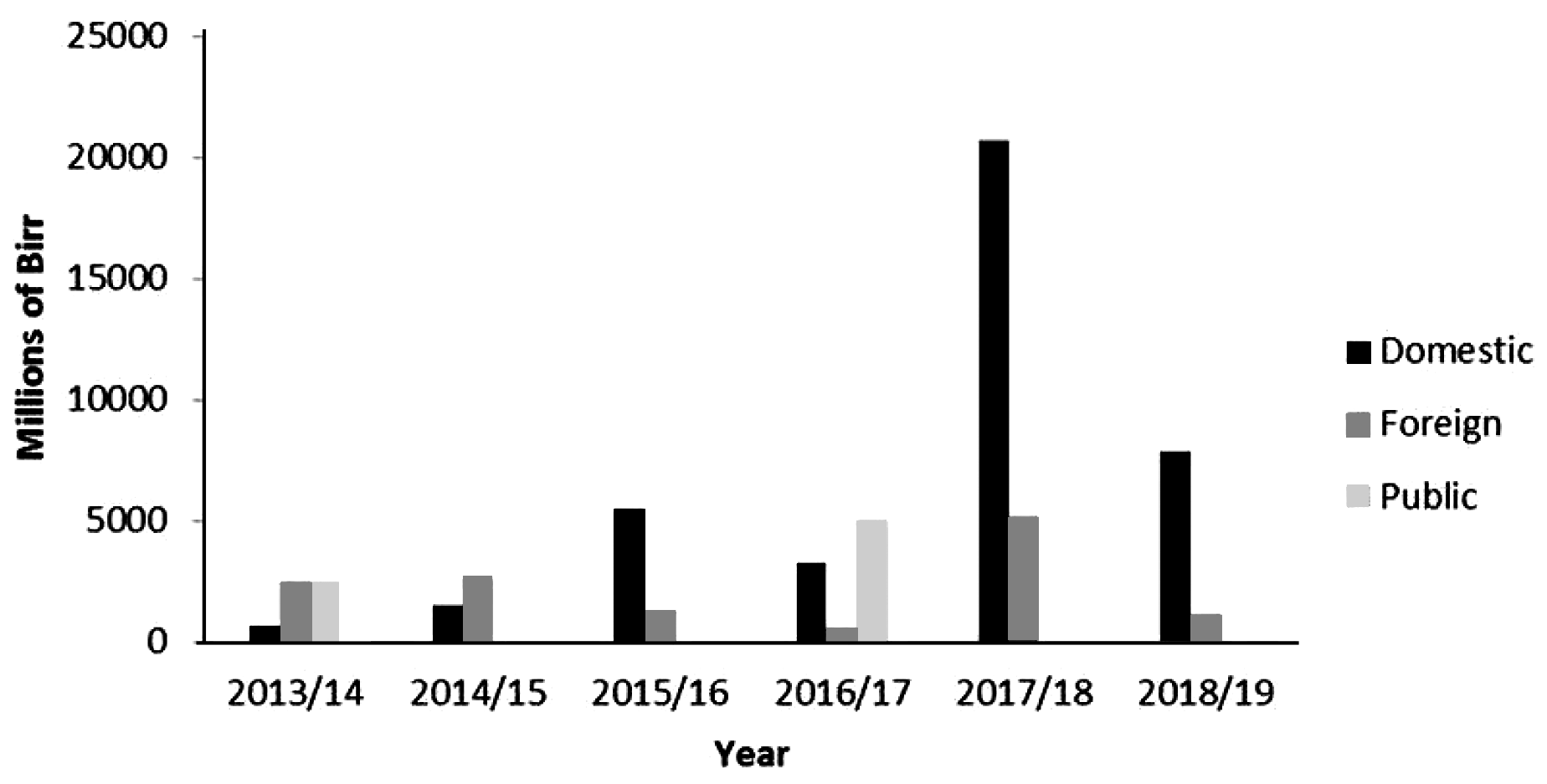

Fig. 4. Capital of Operational Investment Projects by Type. Source: [5].

Ethiopia is among the developing countries with high rate of economic growth in the last decade. It has registered impressive GDP growth, ranging between 6% and 12%. This high growth rates have contributed to improvement of living standards of the population, an increase in per capita income as well as absolute poverty reduction. Figure 2 shows the GDP of Ethiopia in constant 2010 $ in 1992-2018.

Recently, evidence from UNCTAD and World Bank [1; 4] indicated a large FDI inflow to African countries, including Ethiopia. In order to attract FDI, Ethiopia took important steps towards liberalizing trade and macroeconomic policy as well as introduced some measures to improve the FDI regulatory frameworks. Figure 3 shows the trends of FDI flows to Ethiopia which is growing starting from 2012 to recent.

Ethiopia has attracted a total FDI of $3.75 bln in Ethiopian fiscal calendar ended July 7, 2018 and additional $843 mln FDI in July-December 2018 [1].

The data below on the number and capital of operational investment projects in Ethiopia in 2013-2018 show that foreign capital inflow is by no means the biggest source of investment, but supplements the domestic investment in the real sector of economy of the country (see Figure 4).

Though the respective size of foreign direct investment is smaller than the domestic investment, it is important. The significance of FDI in terms of its impact on Ethiopian economy consists in creation of new industries, transfer of new technologies, upgrade of marketing and management practices, new jobs creation, and the other improvements.

The bulk of FDI to Ethiopia comes from China, Saudi Arabia, Turkey, India, and European Union. In 1992-2017 Ethiopia received FDI from China in amount of $2.2 bln (24%), from Saudi Arabia – $1.5 bln (17%), from Turkey – $992 mln (10%), from India – $724 mln (8%) and from the Netherlands, France, Ireland, Germany and UK – $689 mln (7,6%) [5].

FDI to Ethiopia predominantly flow to the three major sectors of the economy: the manufacturing sector, service sector, and the agriculture sector. The Government and business sector of Ethiopia were successful in attraction of FDI to manufacturing sector, which have got about 46% of the total FDI projects over the period 1992-2016. The service sector received 39% of FDI projects – electricity generation, construction, real estate development, trade, hotel and tourism, transport, education, and health service. The agricultural sector during 1992-2016 attracted 15% of FDI projects [5].

FDI AND THE GOVERNMENT POLICY

In Ethiopia strong points to invest in the country are the fast-growing economy, with a population of around 102 mln people and an emerging middle class. Ethiopia possesses a widespread territory, rich in natural resources and fertile soil, the country has the second labor force in Africa with low salary levels. Next to Egypt, Ethiopia is the second largest market in Africa, the economy is now in a phase of diversification.

FDI into Ethiopia started to grow after the institution of democracy and the liberalization of control of the economy in 1992. The new Government sought to eliminate the constraints on FDI and to establish an enabling environment for foreign investors. In early 1998, the authorities began to promote Ethiopia more vigorously as a location for FDI. In 1999 a new investment guide for potential foreign investors in Ethiopia was published.

In 2002 an Investment Policy Review of Ethiopia was adopted. The review was focused on investment policy and gave special consideration to technological development and research to develop the potential of the agriculture sector and improve productivity. The leather and leather products sectors were also emphasized where FDI were welcomed. Investors expressed satisfaction in general with measures taken by the Government of Ethiopia to improve the regulatory environment for foreign investment. This is reflected in annual FDI inflows, which increased from an average of $214 mln over the 1998-2002 period to average $409 mln in 2003-2007.

Since then there are different reasons why FDI flows to Ethiopia increased continuously form 2013. The Investment Policy Review (IPR) recognized the integral role of investment promotion in increasing FDI flows to Ethiopia. To this end, the IPR made many recommendations related to investment promotion tactics the Ethiopian Investment Agency (EIA) could employ keeping in mind its limited budget and capacity constraints.

As is common in many developing countries, infrastructure can be an impediment to attracting FDI. Accordingly, the IPR made several recommendations to address the development of Ethiopia’s infrastructure. Further, it encouraged increasing linkages between domestic and foreign businesses to help foster a stronger domestic private sector and increase the skills and managerial experience of domestic firms. The Government approved the Growth and Transformation Plan 2010/11 – 2014/15 (GTP) to address these issues.

After many years of search of adequate mutually beneficial regime for foreign capital, nowadays there is a relatively stable climate for investors in the country. State-led policy of FDI attraction is important part of the Government policy of economic development of Ethiopia. The Government proclaims that in Ethiopia there exist strong guarantees and protection for investors, improved economic infrastructure, a regional hub and access to a wide market, competitive incentives package and Government commitment.

Foreign investment framework and opportunities in Ethiopia provide the right to establish private entities, acquire, own, and dispose of most forms of business enterprises (except for a few strategic sectors) for both foreign and domestic investors. All land is owned by the State but can be leased for up to 99 years. Acquisition of holdings, a majority holding interest in a local company by a foreign investor is legal in Ethiopia. A foreign investor intending to buy an existing private enterprise or buy shares in an existing enterprise needs to obtain prior approval from the Ethiopian Investment Commission (EIC). Ethiopia’s Investment Code prohibited foreign investment in banking, insurance, and financial services, along with the following sectors: broadcasting, air transport services (up to 50 seats capacity), travel agency services, forwarding and shipping agencies, retail trade and brokerage, wholesale trade (with some exceptions) and most import trade. Currently the Government has promised partial privatizations of state-owned monopolies in aviation, utilities, and logistics [5; 1].

Important factor, which contributes to FDI attraction is the country’s success in infrastructure development and the construction of industrial parks, initiated by the Government. These parks enable investors to directly commence production in two or three-month duration without bothering about the supply of land, water, electricity, and other infrastructures. In various corners of the country, state-of-the-art industrial parks have been constructed by the Government. Bole Lemmi-I and Hawassa industrial parks have commenced full operation while Mekelle and Kombolcha commenced production partially. Adama and Diredawa industrial parks are also in the pipelines to commence operation. Additional five industrial parks (Jimma, Debrebirhan, Bahir Dar, Bole Lemmi II, Kilinto, and Adama II) and two private industrial parks in Arareti and Diredawa are under construction [6].

Companies from China, India, Turkey and other countries plan to install big factories in Debre Birhan with a view to sell their finished products locally and internationally. Among the major companies currently in early and near completion stages of building factories are Chinese, Indian and Turkish businesses: steel casting project by Sino Steel PLC and a project by Humanwell Pharmaceutical group. Giant Turkish company My Shoe and Leather Manufacturing PLC are currently building factories in Debre Birhan. The joint company Sino Steel PLC Ethiopia is currently building a factory in Tulefa Kebela to produce rebar and angle iron. The project is equipped with advanced plant and high-quality raw billet [6].

Nowadays Government provides important incentives to foreign investors:

- Income tax exemption period for 2-6 years, and for Industrial Park enterprises and developers 8-10 years and 15 years, respectively.

- Loss carry forward.

- Export tax exemption: except for hides and skins all export products are exempted from export tax.

- Exemption from import customs duty for capital goods, construction materials, spare parts, vehicles, raw materials for export and personal effects (only for Industrial Park enterprises).

- Foreign currency retention: exporters may indefinitely retain and deposit in a bank account up to 30% of their foreign exchange earnings in foreign currency. They can also make use of the remaining

- 70% balance within 28 days as it is.

- No export price control is imposed by the

- National Bank of Ethiopia.

- Export credit guarantee scheme to ensure an exporter receives payment for goods in the event the customer defaults, reducing the risk of exporters’ business and allowing it to keep its price competitive.

- Streamlined and expedited procedures of licensing, permits, registration certificates, tax identification number, customs clearance for enterprises entering parks.

Recently in collaboration with the UN agency for African economic affairs, the Ethiopia Investment Agency has launched online investors’ guide that provides information on investment opportunities and procedures for investors [1].

FDI AS A FACTOR OF ECONOMIC GROWTH

The role of FDI has been widely recognized as being a growth factor for developing countries’ economies. Many economic studies conclude that FDI, being a high-quality addition to limited national physical capital, contributes to capital accumulation, technological progress, and growth of employment and, therefore, may be an important catalyst for industrial development. It is regarded as a means of transferring modern technology and innovation from developed to developing countries. FDI enables receiving countries to achieve investment levels above their domestic saving. The size of the FDI impact on developing countries’ economic growth depends a lot on host country, trade regime, human capital conditions, industries characteristics, motivations for placing an investment, and on interests of all stakeholders involved [7; 8; 9].

FDI AND EMPLOYMENT

FDI is expected to play important role in jobs creation in host country. It directly generates new employment on invested firms and creates jobs indirectly through forward and backward linkages with domestic firms. Several studies have shown that transnational companies pay higher salaries than domestic firms even after controlling for firm and worker characteristics. Furthermore, the presence of multinationals generates wage spillovers: wages tended to be higher in industries and in regions that have a higher foreign presence. It positively affects incomes of working population. FDI reduces unemployment in the short and the long run [10; 11].

There was some reduction of the unemployment rate, reported by Central Statistical Agency of Ethiopia – Ethiopia’s sustained growth brought down unemployment rate from 26.4% in 1999 and 17.4% in 2013 to 19.1% in 2018.

Between 1992-2016, foreign investment projects in Ethiopia created a total of 586,842 jobs, representing a significant portion of the entire jobs created during this period. Between 1992 and 2016, Ethiopia attracted over 5000 realized FDI projects in multiple sectors, creating over 282 thousand permanent jobs. In comparison, domestic private and public projects generated around of 389,876 and 4,812 jobs, respectively, during the same period.

On average each foreign project generated 235 jobs – 113 permanent positions and 121 temporary jobs. Overall, manufacturing sectors accounted for 41% of total permanent jobs created by FDI projects since 1992. The textile and apparel industry take the lion’s share in employment creation largely due to the increased attractiveness of the FDI to the sectors and the labor-intensive characteristic of the industry itself [5].

FDI AND TECHNOLOGY TRANSFER TO ETHIOPIA

It is expected that technological transfer (TT) through FDI to developing countries, including Ethiopia, can help upgrade local industries their competitiveness and, finally, promote economic growth. New technologies could be transferred through training, technical assistance, through methods to upgrade the production quality, via cooperation with local industries.

A quantitative survey of the impact of FDI on TT in the Ethiopian metal and engineering industries [12] – 47 metal and engineering enterprises – indicates that the technological capability of Ethiopian industries to adopt, modify and improve a given technology is very weak, contacts between foreign and local industries are uncooperative, the national technology policies are weak, which does not allow to benefited from the technologies brought by FDI. All in all, as of now the absorptive capacity of the Ethiopian industry is low.

Analysis of Strengths, Weaknesses, Opportunities and Threats (SWOT) for technology transfer to Ethiopia, provided by authors of “2016/17 Knowledge Sharing Program with Ethiopia” shows quite complex situation with absorption of foreign technologies brought to the country via different channels, including FDI [13, p. 46], and gives practical recommendations to policy makers for enhancing the effect of TT through incoming FDI.

The authors of the analysis recommend setting up a system to ensure TT with incoming FDI. For that they advise specifying the details of content in the technical contract for TT and negotiating them with foreign countries as contracting conditions in FDI: Free technical information; Paid technical training; Priority to the institute in the transfer company for granting technical licenses to other domestic companies; Priority to transfer companies in crosslicensing with foreign companies; Guarantee for use of certain percentage shares of domestic parts; etc. It is strongly recommended to revise the proclamation on investment (Proclamation No 769/2012) to facilitate and address problems on TT activities in Ethiopia.

FDI AND HUMAN CAPITAL ENHANCEMENT IN ETHIOPIA

Many researchers [14; 15] suggest a link between FDI and human capital enhancement via development of abilities and skills of laborers in general and on-the-job training (learning-by-doing): training programs of all types, which help acquiring knowledge and skills, especially in new technologies usage, increase the productivity of labor.

Ethiopia has devoted big resources to develop education and health sectors aiming at later increasing productivity and economic growth. Foreign companies and organizations in different forms participate in these activities: there are foreign private initiatives, especially from big companies, and projects, implemented together with international organizations and Ethiopian Government. They discuss the skills transfer by foreign investors to Ethiopian labor force in different industries (the footwear, auto assembly/parts, textiles, industrial materials, construction, and logistics sectors) and come to conclusion that the efforts of foreign investors on company level are not sufficient, and that targeted policy implementation by the Ethiopian Government to enforce skills transfer by foreign investors is needed. It will go through building joint activities of foreign companies with local, foreign and international training institutions.

The example of such international cooperation between foreign and local investors can be the project “Establishment of a vocational training center in Mekelle for skilled workers and managers in the textile sector”, commissioned by German Federal Ministry for Economic Cooperation and Development (BMZ),with partner H&M Hennes & Mauritz AB, DBL Group. The goal of the project is to prepare well-trained national skilled workers and managers to boost growth in the Ethiopian textile sector. The plan is to set up the ‘Centre of Excellence for the Textile Industry’ at which prospective specialists and managers will complete training in accordance with international standards. The partner companies will provide the necessary machinery in the DBL premises at the Mekelle Industrial Park and pass on their industry knowledge. The project partners will also develop needs-based training documents for junior and senior management positions, and skilled workers, such as mechanical engineers and quality experts [16].

Nowadays, new forms of business training, implemented by foreign companies, appear. Among recent announced initiatives worth mentioning the Alibaba Netpreneur Training Program (AlibabaGroup, China), an ecommerce training program, which targets entrepreneurs and business owners in Ethiopia. This program is part of the agreements signed between the Government of Ethiopia and Alibaba Group announcing the establishment of an eWTP Hub in Ethiopia in 2020 [17].

FDI AND EXPORT PROMOTOION

In 2018 the export of Ethiopia accounted for 8.38% and the import 22.8% of GDP, so the total foreign trade represented around 31% of GDP, which characterizes Ethiopia as a small open economy.

Ethiopia’s export sector remains particularly small – total goods and services exports do not exceed 10% of GDP. The major export items of Ethiopia in 2018-2019 were: coffee (28.7%), oilseeds (14.5), chat (11.4), pulses (10.2), flower (9.6, leather and leather products (4.4%) The major destinations for Ethiopian merchandise export were Asia (41.6%), Europe (25.4), Africa (20.8), and America (11.3%) [19, pp. 77, 84].

As can be seen from these data, the spectrum of exported goods is quite narrow and is limited to agricultural commodities. A decline in export value in 2011-2017 was mainly due to disadvantageous international commodity price fluctuations and few commodity choices for export. Diversification of production and export is needed and in this respect FDI to Ethiopian economy could play a positive role.

FDI to Ethiopian economy affect the economic growth of the country not only through capital formation, but also through impact on export and import of goods and services. The impact of FDI on export of Ethiopia was studied by Ethiopian economists Mahmoodi [20], Tadesse [21], and others. It is recognized that foreign direct investors potentially affect the host economy through firms’ capacity building, technological transfer, upgrading of production, management and marketing skills of locals, organization of export production and sales on international markets. At the same time, foreign firms compete with local producers and may crowd them out of the domestic and international markets. Foreign producers also compete for financial resources on domestic market, use benefits, which the Ethiopian Government provides to attract FDI.

FD investors demonstrate entire spectrum of strategies in their export production and sales in international markets. The cases of traditional Ethiopian leather and leather products industry and a new cut flower industry, established by foreign investors from the scratch, show these differences.

Ethiopian researcher Tessema [22] notes that in leather industry FDI exporting firms do as much processing as possible outside Ethiopia. Partially this is due to bureaucratic climate, difficulties with logistics network, industrial norms and safety requirements, which they try to overcome. Some leather companies either import semi-processed inputs into the country or only export semi-finished products to ensure smooth final delivery of products to their destination. At the same time, using their technical and business superiority they crowd out local producers from traditional exporting activities. This reduces the positive effect of export oriented FDI on economic development in Ethiopia.

On the other hand, the Ethiopian flower industry, which emerged with FDI support in the late 1990s, represents an extraordinarily fast and successful diversification into a non-traditional export product. Ethiopia has become the 4th largest non-EU exporter to the EU cut-flower market and the 2nd largest, after Kenya, flower exporter from Africa, exporting to the Netherlands, France, Germany, Italy, Canada, Norway, Sweden, UK, the Middle East, and other countries.

The original driving force for the development of this industry was FDI. Foreign investors, initially Dutch investors, brought this business to Ethiopia. They participated in creation of the cut flower value chain: (1) organized of production for export; (2) organized trade – two thirds of the total Ethiopian export went to the Dutch market via its two auctions, VBA and FloraHolland; (3) established key institutions for Ethiopian flower industry [23]. Later, many domestic and foreign investors entered this industry and promoted competition. Industry players use all domestic comparative advantages – favorable climate, soil, cheap labor, multiple investment benefits provided by the Government to develop efficient and profitable industry, which creates jobs and provides export revenues to the country. There are projections for further future growth of floriculture in Ethiopia.

Proper strategy, norms, regulation, and adequate support by Ethiopian Government are needed to explore positive effects of FDI activity in the country.

CONCLUSIONS

In this study the impact of FDI on economic development of Ethiopia was analyzed. The role of FDI has been widely recognized as being a factor of the economic growth of developing countries. Analysis performed in this paper shows that there is an intensification of activity of FDI from China, India, Turkey, Saudi Arabia, the European Union.

Steady growth of FDI inflows observed in Ethiopia is largely due to the active stimulating role of the Government. The active development of infrastructure and industrial parks attracts foreign companies to build modern plants with advanced equipment and technologies.

Sector analysis shows that FDI has an important impact on employment via job creation in launched greenfield projects and spillover effects in related value chain industries. New industries, like cut flowers industry, are created from the scratch. Production plants based on FDI bring positive fruits in the form of technology transfer, human capital enhancement through training of skilled workers and wider “learning-by-doing”. New forms of business training, like, for example, ecommerce training program are commenced. The export promotion by FDI-based firms is another positive feature of their activities.

At the same time tougher competition in traditional industries, for example, leather industry leads to some crowding out of local firms from exporting business. Attraction of more FDI to solve the problems of economy diversification, unemployment, human capital enhancement, technology transfer and foreign trade promotion is important. To attract more FDI and absorb properly its potential positive effects as well as suppress undesirable ones, a solid policy framework to create conducive environment for investment in national interests is needed.

Библиография

- 1. World Investment Report 2018: Investment and New Industrial Policies. UNCTAD. UN publication, Geneva. https://unctad.org/en/PublicationsLibrary/wir2018_en.pdf (accessed 05.03.2020)

- 2. Foreign direct investment to Africa defies global slump, rises 11%. UNIDO, 25 June, 2019. https://unctad.org/en/pages/newsdetails.aspx?OriginalVersionID=2109 (accessed 05.04.2020)

- 3. Ethiopia attracts $843 mln foreign direct investment. New Business Ethiopia Portal. January 25, 2019. https://newbusinessethiopia.com/investment/ethiopia-attracts-843-mln-foreign-direct-investment/ (accessed 05.03.2020)

- 4. World Development Indicators 2019 data. https://data.worldbank.org/indicator/BX.KLT.DINV.CD.WD?locations=ET (accessed 05.03.2020)

- 5. Ethiopian Investment Commission 2018. https://www.state.gov/reports/2018-investment-climate-statements/ethiopia/ (accessed 05.03.2020)

- 6. Ethiopia’s Astounding Achievement in Attracting FDI. https://allafrica.com/stories/201805310455.html (accessed 05.03.2020)

- 7. Selamawit B.W. (2015). Foreign direct investment and economic development in Ethiopia. Applied Economics and Finance, Copenhagen Business School, Master Thesis. https://studenttheses.cbs.dk/bitstream/handle/10417/5863/selamawit_berhe_woldekidan.pdf?sequence=1 (accessed 05.03.2020)

- 8. Zhang K.H. (2001). Does foreign direct investment promote economic growth? Evidence from East Asia and Latin America. Contemporary Economic Policy. Vol. 19, No. 175-185. https://www.econstor.eu/bitstream/10419/2616/1/kd380.pdf (accessed 05.03.2020)

- 9. Nunnenkamp P. (2001): Foreign direct investment in developing countries: What policymakers should not do and what economists don’t know. Kieler Diskussionsbeitrдge, No. 380. Kiel Institute for the World Economy (IfW), Kiel. https://www.econstor.eu/bitstream/10419/2616/1/kd380.pdf (accessed 02.03.2020)

- 10. Lipsey R.E., Mucchielli J.L. (2002). Multinational Firms and Impacts on Employment, Trade Technology: New perspectives for a new century. London and New York: Rutledge. https://www.routledge.com/Multinational-Firms-and-Impacts-on-Employment-Trade-and-Technology-New/Lipsey-Mucchielli/p/book/9780415270533 (accessed 05.03.2020)

- 11. Stamatiou P., Dritsakis N. (2014). The Impact of Foreign Direct Investment on the Unemployment Rate and Economic Growth in Greece: A Time Series Analysis. https://www.researchgate.net/publication/273909610_The_Impact_of_Foreign_Direct_Investment_on_the_Unemployment_Rate_and_Economic_Growth_in_Greece_A_Time_Series_Analysis (accessed 05.03.2020)

- 12. Lemma Y., Kitaw D., Gatew G. (2014). Impact of Foreign Direct Investment on Technology Transfer in the Ethiopian Metal and Engineering Industries. International Journal of Scientific & Technology Research. Vol. 3, Iss. 4, April 2014. http://www.ijstr.org/final-print/apr2014/The-Impact-Of-Foreign-Direct-Investment-On-Technology-Transfer-In-The-Ethiopian-Metal-And-Engineering-Industries.pdf (accessed 01.03.2020)

- 13. 2016/17 Knowledge Sharing Program with Ethiopia. Gearing up Ethiopia with Innovative Initiatives: Technology Transfer, Manufacturing, Urban Planning. http://www.kdi.re.kr/kdi_eng/pub/15366/2016_17_Knowledge_Sharing_Program_with_Ethiopia&pg=5&pp=10&mcd=002003 (accessed 01.03.2020)

- 14. Fei Ding (2018). Work, Employment, and Training through Africa-China Cooperation Zones: Evidence from the Eastern Industrial Zone in Ethiopia. Working Paper No. 2018/19. China Africa Research Initiative, School of Advanced International Studies, Johns Hopkins University. Washington, DC. http://www.sais-cari.org/publications (accessed 05.03.2020)

- 15. Training of skilled workers and managers for the textile industry (Ethiopia). (2018) UNIDO. https://www.unido.org/stories/hands-training-ethiopia-partnering-better-future (accessed 05.03.2020)

- 16. Establishment of a vocational training centre in Mekelle for skilled workers and managers in the textile sector. German Federal Ministry for Economic Cooperation and Development (BMZ). 2018. https://www.giz.de/en/worldwide/68989.html (accessed 20.03.2020)

- 17. Alibaba Invites Ethiopian Entrepreneurs, Businesses for Free Training. 2020. https://newbusinessethiopia.com/technology/alibaba-invites-ethiopian-entrepreneurs-businesses-for-free-training/ (accessed 05.03.2020)

- 18. World Bank data (2019). https://www.mdpi.com/2227-7099/6/4/64/htm# (accessed 05.03.2020)

- 19. National Bank of Ethiopia Report 2018-2019. https://nbebank.com/wp-content/uploads/pdf/annualbulletin/report-2018-2019.pdf (accessed 05.03.2020)

- 20. Mahmoodi M., Mahmoodi E. (2016). Foreign direct investment, exports and economic growth: evidence from two panels of developing countries. Economic Research-Ekonomska Istrazivanja. 29(1): 938-949. January 2016. https://www.researchgate.net/publication/311851803_Foreign_direct_investment_exports_and_economic_growth_Evidence_from_two_panels_of_developing_countries (accessed 06.03.2020)

- 21. Tadesse G.G. (2017). The Role of foreign direct investment for the export growth of leather industry in Ethiopia. Master thesis. http://etd.aau.edu.et/bitstream/handle/123456789/8894/Tadesse%20Gurmu.pdf?sequence=1&isAllowed=y (accessed 06.03.2020)

- 22. Tessema W.K. (2019). Impact of Foreign Direct Investment on Export Performance: The Case of Ethiopia. Master thesis. https://thekeep.eiu.edu/theses/4443/ (accessed 06.03.2020)

- 23. Melese A.T., Helmsing A.H. Endogenisation or Enclave Formation? The Development of the Ethiopian Cut Flower Industry. The Journal of Modern African Studies. Vol. 48, No. 1 (March 2010), pp. 35-66. https://www.jstor.org/stable/40538347?seq=1 (accessed 06.03.2020)